Take Loan Online - The Key to Achieving Your Business Goals

Introduction

In today's competitive business landscape, having access to adequate financing can make all the difference in taking your Medical Centers, Diagnostic Services, or Orthopedists practice to the next level. Whether it's expanding your facilities, investing in advanced technologies, or hiring skilled professionals, sometimes businesses require financial assistance to achieve their goals. That's where taking a loan online can play a vital role.

The Benefits of Taking Loans Online

With the advancement in digital technology, the process of obtaining a loan has become faster, more convenient, and highly accessible. CeePass.com understands the unique financial needs of businesses in the Medical Centers, Diagnostic Services, and Orthopedists industry. Here are some key benefits of taking a loan online from CeePass.com:

- Convenience: Applying for a loan online allows you to skip the tedious paperwork and lengthy approval process. You can complete the application from the comfort of your office or home, saving valuable time.

- Accessibility: CeePass.com offers loans online, which means you can access their services anytime, anywhere, as long as you have an internet connection. This ensures quick and seamless financial assistance when you need it the most.

- Competitive Rates: CeePass.com understands the competitive nature of your business and offers loans at competitive rates, ensuring you can maximize your return on investment for various projects or initiatives.

- Flexible Repayment Options: CeePass.com provides flexibility in choosing repayment terms that align with your business's cash flow. This ensures that your loan repayment is manageable and doesn't strain your financial resources.

- Specialized Financial Solutions: CeePass.com specializes in providing loans specifically tailored to the needs of Medical Centers, Diagnostic Services, and Orthopedists. They understand the unique requirements of these businesses and offer customized financial solutions to meet their specific demands.

How to Apply for a Loan Online

Applying for a loan online with CeePass.com is a straightforward process. Follow these simple steps to get started:

- Research: Begin by exploring CeePass.com's website to understand the loan options available for Medical Centers, Diagnostic Services, and Orthopedists. Take note of the specific loan terms, interest rates, and eligibility requirements.

- Prepare Documents: Gather all the necessary documents required for the loan application process, such as financial statements, identification proofs, business licenses, and any other relevant paperwork. Ensure that all your documents are up to date and organized.

- Online Application: Fill out the loan application form provided on CeePass.com's website. Make sure to provide accurate and detailed information to expedite the approval process.

- Submission and Review: Once you have submitted your application, CeePass.com will review your information and verify the provided documents. This may involve a credit check and a comprehensive assessment of your business's financial health.

- Approval and Disbursement: Upon successful verification and approval, CeePass.com will work closely with you to finalize the loan agreement. Once the agreement is signed, funds will be disbursed directly to your nominated account, allowing you to make use of the loan for your business needs.

The Importance of Taking Loans Online

Taking a loan online from CeePass.com can have a significant impact on the growth and success of your Medical Centers, Diagnostic Services, or Orthopedists business. Here are some reasons why:

1. Expansion Opportunities:

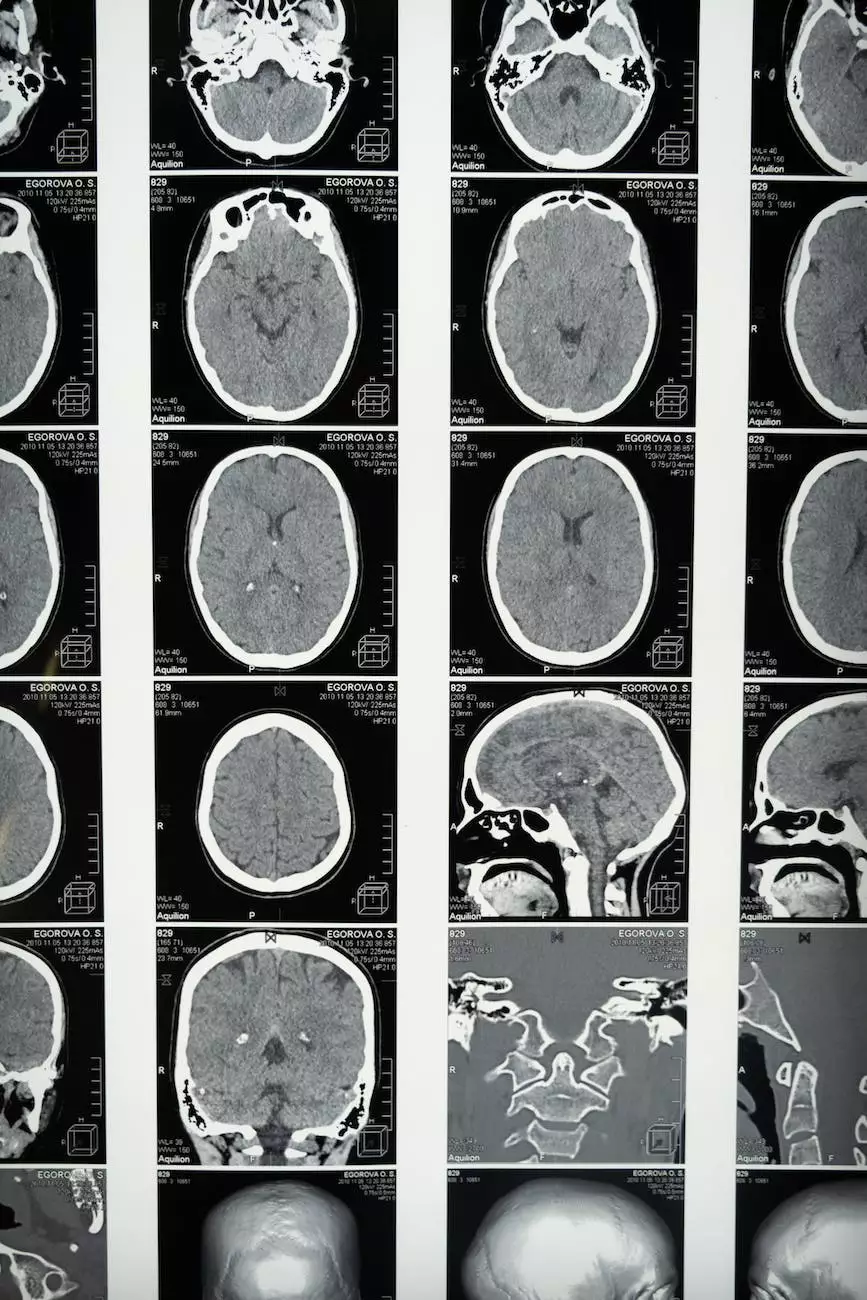

With access to quick and reliable financing, you can seize expansion opportunities as they arise. Whether it's opening a new branch, investing in state-of-the-art equipment, or renovating your existing facilities, taking a loan online allows you to take the necessary steps to grow your business.

2. Enhanced Service Offerings:

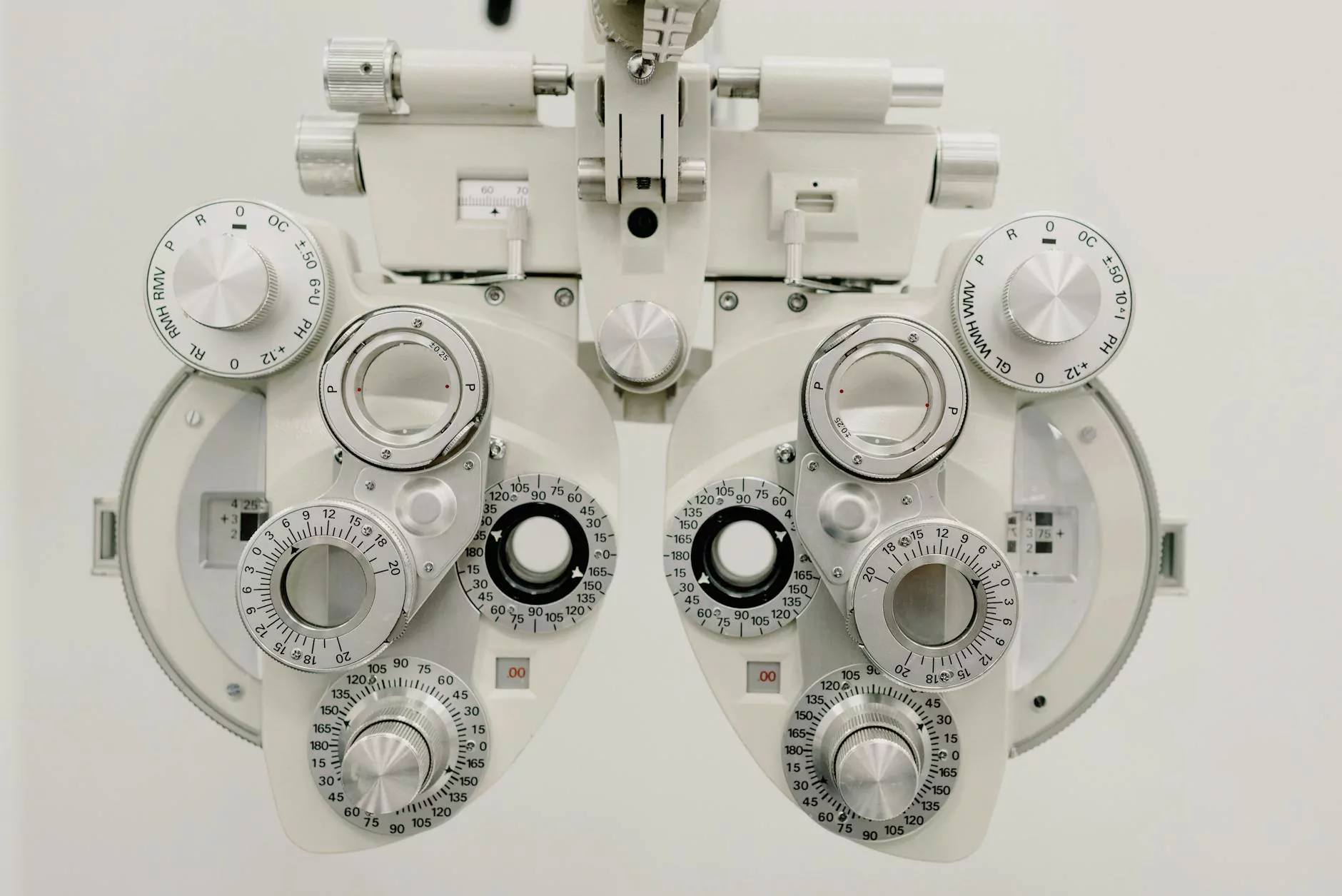

By securing a loan, you can invest in advanced diagnostic tools, cutting-edge technologies, and specialized equipment. This enables you to provide a wider range of high-quality services and stay ahead of your competition. The loan can also support training programs for your staff, ensuring they are up-to-date with the latest industry advancements.

3. Attracting Top Talent:

Taking a loan online can help you finance competitive compensation packages for highly skilled professionals. By offering attractive salaries, benefits, and development opportunities, you can attract and retain top-notch talent, which is crucial for delivering exceptional patient care and maintaining a strong reputation in the industry.

4. Marketing and Advertising:

With a loan, you can invest in marketing and advertising initiatives to promote your Medical Centers, Diagnostic Services, or Orthopedists practice. This includes creating a robust online presence, running targeted advertising campaigns, and implementing effective marketing strategies. A strong marketing plan can increase your visibility, attract new patients, and ultimately boost your revenue.

In Summary

For businesses operating in the Medical Centers, Diagnostic Services, and Orthopedists industry, taking a loan online can be a game-changer. CeePass.com offers a streamlined and convenient process, competitive rates, and specialized financial solutions to meet your unique requirements. With the right financing, you can unlock growth opportunities, enhance your service offerings, attract top talent, and effectively market your business. Don't let financial constraints hold you back - take a loan online and propel your business to new heights with CeePass.com!

take loan online